Trending to Zero

I joined the workforce pretty young, I was 14 and my first job was honestly one of the best jobs I have ever worked, for a period of time. The job was simple, I was paid in cash to hire out electric bikes at a 5 star resort — nothing more and nothing less. What made this even better was that I was to do absolutely nothing until someone came into reception and said they wanted a bike; reception would give me a call and I would come to give them a helmet, make them sign a waiver and off they went.

This may seem like an honest job, but I was paid to be there for 8 hours a day; that’s a long day for about 30 minutes of total work. I started calculating how much I was earning per minute of actual ‘work’ I had completed and understood the goldmine I had happened upon. Throughout the day I’d listen to music and read books, and if there was a particularly good day of foot traffic I’d be paid commission on the bikes that were booked. Life was pretty great there for a while, it felt too good to be true — perhaps because it was.

Soon enough my boss realised that paying me to do next to nothing wasn’t a particularly good use of his capital, so he decided to fill up the rest of my day. What was once reading by the pool with headphones turned into gardening gloves and shovelling mulch in the hot Australian summer, yet the pay remained the same. I look back on this time and still can’t believe that I was once paid to do nothing, but at the time I had completely normalised that I deserved to be paid for little more than showing up on time.

Then I grew up, learned that if something is too good to be true it almost always is and didn’t think about the concept of receiving money for nothing again. This was until I discovered NFTs and heard about these pixelated monkeys earning thousands per month (at the top it was per day) for doing nothing but holding an asset that many purchased for less than $100 and I thought to myself, wow, how could that possibly be — they don’t even have to pretend to be busy, they just receive a dividend every day.

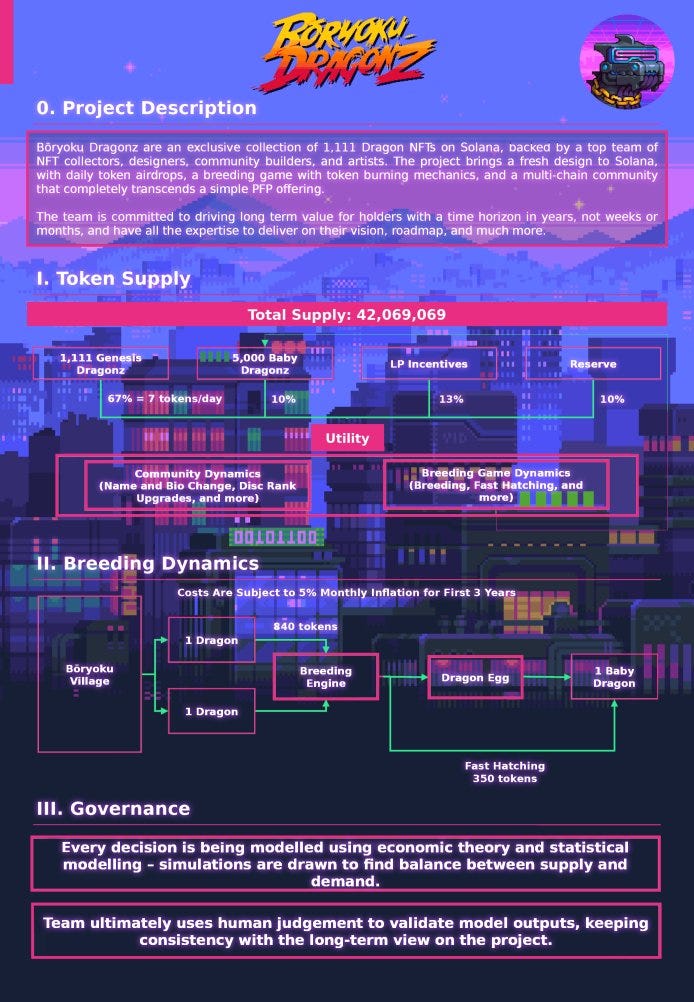

It was too expensive for me at the time so my brain moved on, fortunately given the gas fees on ETH it was quite complex for other projects to mirror the CyberKongz model, then along came Solana. It can be argued that the birth of the Solana ponzi was far long ago with one of the many DeFi tokens that went to zero (RIP コープ), but for NFTs there is no doubt the Boryoku DragonZ started the trend of so called ‘utility-NFTs’ on Solana.

Oxford Languages defines utility as “the state of being useful, profitable, or beneficial”. I think that is a great definition of something that provides utility, let’s delve in to see how some of our favourite NFT tokens hold up against this definition of utility.

If Bernie Madoff was reincarnated into the body of a 20 something year old during the NFT boom he would have felt right at home and his favourite phrase would no doubt be ‘utility token’. With one simple phrase you can inflate the underlying asset while drip feeding all your investors visible daily rewards, all of which cost you nothing; and the best part is that they can never ask for their money back from you they simply have to find another willing buyer at the current fair market price, which you even get a cut from!

The Dragonz team took a lot of inspiration from the Cyberkongz model, which is evident if you compare the roadmap and tokenomics. The value proposition for $BOKU is simple in the beginning, you buy a dragon and receive 7 tokens per day which equates to 67% of the total supply allocated to 1111 holders (inc the 111 pre-minted for team and promo). In order to incentivise holders to not sell this token, breeding is implemented so that there is a need to hold your $BOKU. If you accrue or buy enough $BOKU and hold two dragonz, you are able to click a few kinky buttons to successfully pimp your dragonz out. After the dragons have had time for their intimacy, you will receive one egg — that egg will eventually hatch into a baby dragon and badda bing badda boom you have another NFT that hopefully someone wants enough to justify others continuing to hold their tokens for breeding purposes.

It can be argued that for crypto to move forward as an advanced asset class we need to continue experimenting with projects like this. It can also be argued that the team did everything they could for it to be successful, they planned to have the vesting of the tokens long enough so that it was sustainable and the breeding was spaced out for demand to catch up. Unfortunately, crypto is an extremely reflexive asset class and what happens in a speculators market is it gets blown completely out of proportion, quickly. They shipped their roadmap as intended and potentially the team just moved too fast which outpaced the demand for what was delivered.

The common theme for many of these tokens is that their all time high price generally comes soon after inception and is usually aligned with the time period before the token has done anything — illiquid speculation at its best. Here are a few examples of notable utility tokens, important to add that as of the time writing this most crypto tokens are down 70–90% off the back of the May ’22 crash, although I believe the effect on these tokens to be inevitable or simply accelerated.

Here we see the price of $BOKU reaching it’s all time high only 11 days after trading first began, this was in the lead up to breeding being live and of course holders loading up so they could get their babies before others.

The all time high for $DUST was after 40 days of trading and spiked in the lead up to and directly after the Deadgods art upgrade + increased $DUST generation occurred. Degods also had an interesting tactic with incrementally increasing the amount of $DUST required to perform this process, which translated to a rush of buyers to ensure, ironically, they got the cheapest price for the upgrade. Worth mentioning that $DUST has a halving mechanic that does help offset some of the inflation.

Mindfolk was another mint that came long enough after the Dragonz were established which had people keen to call them ‘the next big thing’. Speculators were so excited for their breeding (building) that the all time high for $WOOD was reached just 8 days after trading began. Their system of breeding allowed holders to increase the amount of $WOOD generated per day, which created even more sell pressure on the token and was impossible to unwind. One of the quickest collapses out of them all, and unfortunately the only one which I had exposure too—greed is powerful thing!

It really is a case of ‘is this time different?’ when it comes to these tokens, the CyberKongz team were the trail blazers in this space and hit the same wall all other projects face. You return so much of the tokens to the genesis asset, how can you continue to return equal value to future expansions of the project? As soon as that question can’t be answered, then the rest collapses pretty quickly. The CyberKongz team have the benefit of truly being first and developing a reputable brand within the ecosystem, while also moving quite slowly forward, the Solana alternatives do not have this luxury.

So let’s return to our framework of “the state of being useful, profitable, or beneficial”. I would say that a utility token is useful, profitable and beneficial to a project for approximately two months, usually less so. Once the primary use case for the token has begun (usually breeding), then the token is simply a very heavy burden for the founders to bear for the rest of eternity. Two months is also just long enough for holders to convince themselves the project is a passive income generator, as soon as that narrative begins to shift there is a core group of holders unhappy and looking for new utility to be added into the token.

Being the founder of a project is no easy task, it is essentially like being a founder in any industry except your investors are mostly inexperienced retail who are expecting returns of 100x, immediately. Should you not be able to return this 100x value then they will be displeased, while they are displeased new entrants will come in at a higher rate with new expectations. Now imagine you create a project and work tirelessly to be able to generate X amount of value, which you can legitimately be proud of because that is no easy task. For every X value of revenue you generate you have 5000 individual mouths to feed, each and every one of those mouths are given new tokens to dump each day over and over again, but X can only go so far. Teams have to essentially choose where they would like to return value to, which will always create at least one weak link.

The examples are easy to spot with each project, of course this is much easier in hindsight than when you are swept into the FOMO storm. Mindfolk are a great example of a project that looked great in the utility token space, but simply had too many moving parts to return value to and inevitably collapsed. Mindfolk was my single largest (unrealised) loss of the NFT bull market, I liked to tell myself that I was hedging just in case I was wrong about utility tokens but no doubt used that as justification to gamble larger size in an unsustainable ecosystem.

A lesson for me there was I let my ego get in the way of what should have been an emotionless trade, I wanted them to be different from the rest because it was my bag, I wanted to earn passive income and I believed in the team - but that didn’t matter, because it’s the model that’s broken. I am confident that if they were to look back on what has happened they would wish a token was not part of the project. They had a lot going for them but unfortunately the burden of managing a token (for eternity) was too great to bear.

We see this same effect in many DeFi protocols, they have a sound business and generate significant revenue, but the operations of the protocol simply returns no value to the token. Think $SRM, $RAY, $FTT, $LINK and the many other tokens that don’t seem to be valued appropriately to the success of the underlying business. These are multi-million dollar projects that have one thing to return value to, which is their underlying token, and even still it seems extremely hard to do.

We are on the absolute furthest end of the risk curve and have convinced ourselves that these projects, that are a handful of months old, with first time founders and retail-backed startup capital, can somehow return value to up to 5 sub-projects all at once with the same operations. There is a first time for everything, but I would wager that we are perhaps mostly delusional to expect a different result.

Another way to look at it is by trying to imagine who the buyer may be and what narrative they are buying into with your favourite ponzi token. Who is the buyer of $WOOD at $0.04 after all known catalysts are over? Who is the exit liquidity for the daily $BOKU dumpers now that the roadmap is completed? Who is adding $DUST to their long term portfolio once Duppies have minted out? Who is adding liquidity to the $SCRAP pool these days? The list goes on and your favourite project is unlikely to be excluded from the pain, but they may perhaps be in a different part of the ponzi cycle, in which case it might be best to reassess your positions.

Essentially my thesis is simple, each token does not need to exist outside of the extremely narrow scope that is the individual project’s roadmap. Attracting new buy-in from outsiders (needed in all ponzis) is very difficult and can only be bribed for so long until those on the inside are left dumping on each other in a race to the bottom. All projects want to create an ecosystem around their token, but have we learned nothing about network effects? If there is any token that will accrue any legitimate value the most rational is $APE for obvious reasons, and even so I still believe that it will not have any significant footprint. $APE has already served its purpose as sweet, sweet exit liquidity for all BAYC holders. Do you believe this time is different and you have invested in what will be the native token for the future of *insert buzzword*?

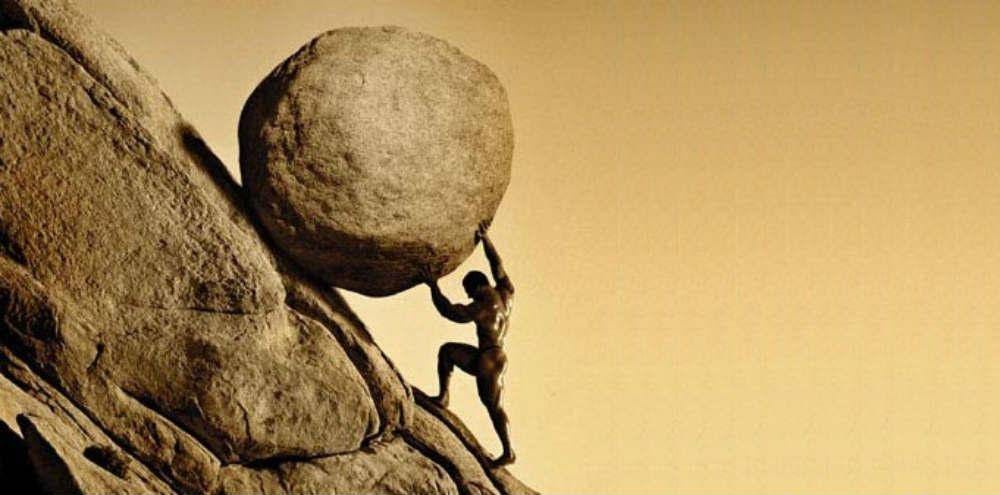

All of these projects hit a point where it is impossible to return value to the token without expansion of supply, and would be impossible to return value to the new supply without inflating the token. A project is only as strong as its weakest link, and creating more weak links is the only way forward for these ecosystems. We will see many try with all their might to prolong their tokens journey to zero; the focus will be on burning as much as possible, staking for as long as possible and handing out little dopamine hits to their holders wherever they can—but that doesn’t change the fact that they will most likely trend towards zero. The question has to be asked, if teams are allocating so much of their time fighting for value returned to their token, is it worth having one at all? In my opinion it is a resounding, no.

One of the worst parts about having a token is that you are obliged to complete what should be raise events in your native token, which acts as a small dopamine hit for the chart starers but a long term whack to the projects treasury and long term success. A good upcoming example here is the Duppies mint from Degods. Now hey, pause a moment, breathe, I’m about to say something negative about Degods—if you feel an inner burning and are compelled to tell me I’m wrong my DMs are never open.

Duppies is a not yet released project by the Degods team. As of the time of writing, $DUST is valued at $1.17, $SOL is valued at $38. This means that at 375 $DUST ($438 USD), the team stand to generate $438 x 15,000 = $6,581,250

That’s a whole lotta green for a team truly deserving of a new raise after so much work put in over the past 9 months, this is the launchpad for what comes next and they can finally expand the team even further…*record scratch*… Wait what? The team is making $0 from this?

This is the unfortunate levels of absurdity that come with attempting to create a sustainable token for your project, remember the mouths to feed? This isn’t to mention the potential tax implications that come with raising that amount of capital at what is very likely to be the highest $DUST price for the foreseeable future. As a holder of any of these projects, would I prefer the core team to have $6.5 million biden bucks of liquid capital to deploy through the bear market, or would I prefer to have a utility token? The burn for these teams is up only, while the revenue is very much dependant on volume.

I would like to summarise with the following, and would absolutely love to be proven wrong. Consider me bold enough to be turned into the Bitcoin pizza purchase screenshot, years from now. But as it currently stands, should none of these projects adjust the total supply of their token, I believe they are all overvalued to the tune of whatever their current price is. Here are the current market prices as I write which can act as timestamps for people to look back on in the months and years to come:

$BOKU is $0.28 (overvalued)

$DUST is $1.17 (overvalued)

$WOOD is $0.03 (overvalued)

$SCRAP is $1.10 (overvalued)

$BANANA is $0.87 (overvalued)

Prove me wrong.

Such a great take on the the irony of "utility" in the NFT space. A lot of people going to be hurt but only because the truth usually does that.

Love the insight and the last photo re pushing shit (token) uphill. Wish I knew it a long time ago. Appreciate the share.