Know When to Walk Away

The year is 2009, as the world around me tries to pick up the pieces left behind from the global financial crisis, I am in a crisis of my own. Blissfully unaware of the financial troubles that were facing the people close to me, I had a war to fight. At that point in my life, Jords was the name and Modern Warfare II was the game. I was playing every day, usually into the early hours of the morning and would regularly sleep at 4am before getting ready for the bus to school less than 3 hours later. The only real reason I would get to sleep was because the servers in Australia would begin to lag after 4am.

I had played games for most of my life to some extent but was always much more consumed with sport and the outdoors. For whatever reason, this game offered enough to get me hooked. Those friends, sports and the great outdoors became nothing more than a time cost to the much more important task that was achieving Prestige 10. When you’re young, it’s much harder to be self-aware of your actions—which has led to its fair share of cringeworthy Facebook screenshots.

I remember specifically that it came to a point where I knew something was wrong, I was never going to admit this to my parents or my friends, but I was actually addicted to this game. I couldn’t log off, it consumed my mind when away from the screen and all my goals were orbiting around MWII; at some point you begin to get frustrated. I thought to myself I am not stupid, I am not like the news articles of kids being addicted to WoW, I’m a sports-loving kid who plays a first person shooter for fun, not like those PC nerds. But eventually you begin to realise that you are indeed no different, with each hour of unwanted gameplay you breakdown the wall between you and the people you didn’t want to be like.

One day I woke up and decided that I did not want to be like this anymore; I went out to the backyard, broke the disk in two pieces and threw them both over the fence. It is said that when people jump off a bridge and survive, the first thing that the brain does is overwhelm you with the fact you have just made the worst decision of your life, I believe if you step away from an unhealthy habit, your brain does the opposite. Once I finally burned the boats and there was no path to turn back—there was nothing but bliss. I jumped on MSN to message a friend, picked my surfboard up and life went on. My dad always said that a cheap lesson is a good lesson, and although this one cost me a lot of time, it was indeed cheap. Unfortunately for those in the crypto market, lessons seldom come packaged in a cheap box.

When you first get introduced to the concept of investing, it’s usually by a parent or family member who has been holding index funds for many years—this is a very healthy gateway into the world of speculation. The goal for most of the population when it comes to investing is to shave a few years off their retirement age, while trying to outperform the inflation rate and the interest rate offered from banks. The mindset is obvious and rarely turns investors into traders with smaller timeframes of wealth generation.

Like many, I first delved into the world of cryptocurrency through Youtube with reputable titles such as “How I made a million dollars in 30 days” and “MASSIVE Bitcoin pump inbound”. You begin to absorb this content and soon realise that all of these guys have one thing in common, leverage. The videos usually begin with advertisements for crypto exchanges offering leverage trading with massive sign-up bonuses, the middle of the video is them drawing lines on a chart and being extremely confident about what will happen and then it will wrap up with another referral link plug to trade 125x leverage on *insert exchange*.

As humans we tend to gravitate towards the best user experience available, in crypto this generally comes in the form of a centralised exchange phone app. The cocktail of a trading platform on your phone, leverage and arrogance usually ends far worse than a hangover the next day. Once you take your first haircut trying to figure out how things work, you’ll likely find yourself on what we call Crypto Twitter (CT). One of the first things that struck me by surprise is that on CT it was cool to flex your wealth, everyone was winning every day and after a few days I was convinced that I was the only loser in the room. My goal quickly changed from being the Bitcoin HODL’r I intended on being to needing millions in a short period of time.

It wasn’t enough to outperform the S&P 500, it wasn’t enough to make legitimate life changing money, I needed to make it. In a matter of days on CT, my perspective had shifted from the gratitude of making money never made before, to the crippling envy of my new peers who were making the real money. What our brain fails to realise is that everything is simple statistics; every day someone on Earth has the best day of their life, a clearly impossible feat for one person. Twitter’s algorithm shows us the best day in the life of many individuals, compiled into one smooth user experience, usually highlighting big profits.

To add to the toxicity of Twitter compiling a suite of amazing achievements that you could never match, it’s also impossible to verify when someone is simply showing their best (and most profitable) self. My old manager once told me a story about her grandmother who was addicted to slot machines, it seemed like she was always winning and the family didn’t quite understand it. One day, they found out that in an effort to front-run them confronting her about the addiction, she would simply withdraw new cash out of the ATM after she was finished losing money—then be able to return to the table with her new ‘winnings’ to show the group. She had to go out of her way to try and deceive loved ones that she was indeed defying the odds, however, on CT you can simply share your one winning trade and sweep the rest under the rug.

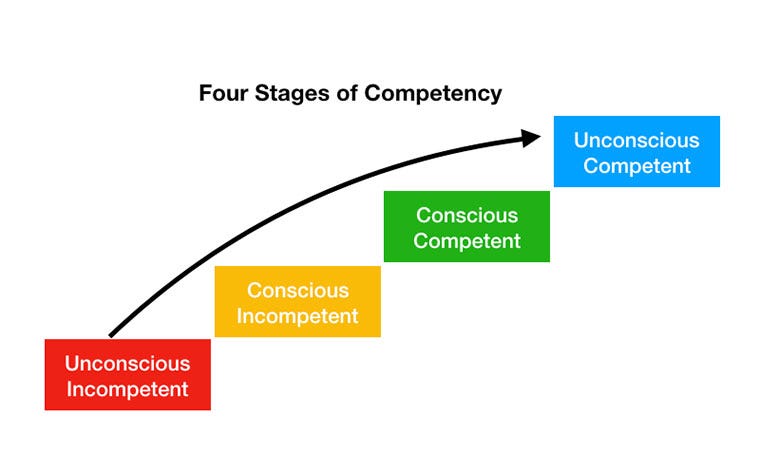

Many early in their crypto journey catch on to the fact that most of the Youtubers are in fact larping and do not make their money via trading full-time, they are simply content creators profiting off the losses (referrals) of the retail market participants they send to the slaughter. What I don’t believe is recognised enough is just how many people on Twitter have no idea what they are talking about, yet deliver their thoughts with the same confidence as a seasoned veteran (Dunning-Kruger Effect). This last sentence might come off as perhaps hypocritical, but it needs to be said and you can decide if it also applies to me, as you should do with all content on the internet.

Every industry has idyllic figures, these are people who represent the ideal person that you would like to become should you be successful in the space. In sports you picture an athletic man or woman, who eats well and is a passionate ambassador for their sport, proudly wearing their sponsors and an advocate for progression. In TradFi you picture a well-dressed fund manager in a board meeting speaking confidently about their 50 years experience on Wall Street. In crypto, you picture an anonymous frog sitting in front of a screen with bloodshot eyes and $50m in open positions. There are of course many exceptions of crypto market participants who live healthy lives and are great role models for us to look up to, but the general consensus still has a pretty large overlap with the 4chan forums of 2012.

In what is objectively insane, words like degenerate, gambling and addict have become admirable traits for new market participants to align themselves with. When you see your heroes referring to themselves as a degen, you begin to believe that is the only path to where they are now in life. For every success story that begins with losing it all, there are millions who did just that—lost everything. We must paint the narrative that anything is possible in crypto, because it is not uncommon for people to lose 90% of their net worth only to see multiple gains on the other side, but perhaps the norm is due for a reset.

All of this leads you be tempted to jump into leverage trading, in spite of many saying that you should not do it, it is simply too tempting to not give it a go. What’s the worst that can happen you tell yourself, I’ll just put in a little bit of money and see what happens. The Dunning-Kruger Effect is once again seen in this journey where many of us overestimate our ability to beat the odds, with zero edge and a dream we put some money on an exchange and off we go. Most people expect to lose their money, but what many don’t foresee is just how terrible of a lifestyle it is trying to leverage trade short term swings. For those who have done this before, you will know exactly what I’m talking about. Ever gone to the bathroom 8 times during dinner just to check your open positions? If you haven’t had the pleasure of the migraine that comes with staring at a 1 minute chart until 5am in the morning, then I would really recommend you learn from the mistakes of others and get the cheapest lesson of all—don’t do it.

The stats aren’t great when it comes to gambling addiction and cryptocurrency market participation, there is a very large overlap of the most popular demographic being young males.

“Rapid online trading platforms and applications were significantly more commonly used by participants reporting excessive behavior and mental health problems. The strong association between cryptomarket trading and excessive behavior in particular underlines the need to acknowledge the potential risks related to real-time trading platforms.”

As reported by this Public Health study, one of the biggest risks comes from real-time trading platforms, which as we know are very prevalent in the crypto space. There is nothing quite as paralysing as having an open leveraged position, watching your PnL fluctuate each second and hoping that the live order book is kind. The same can be said about refreshing the floor price of an NFT collection that you just purchased.

One of the worst days of my life came off the back of being liquidated on a $LINK long position on the bus home from work, on a relative basis it wasn’t the worst thing that could have happened to me but at the time it really felt like a bullet wound. I was staring at my phone screen and couldn’t believe what had happened, when I got home I laid in bed and felt completely useless for doing something so stupid—I would go on to do this a several more times in my life before learning to be responsible.

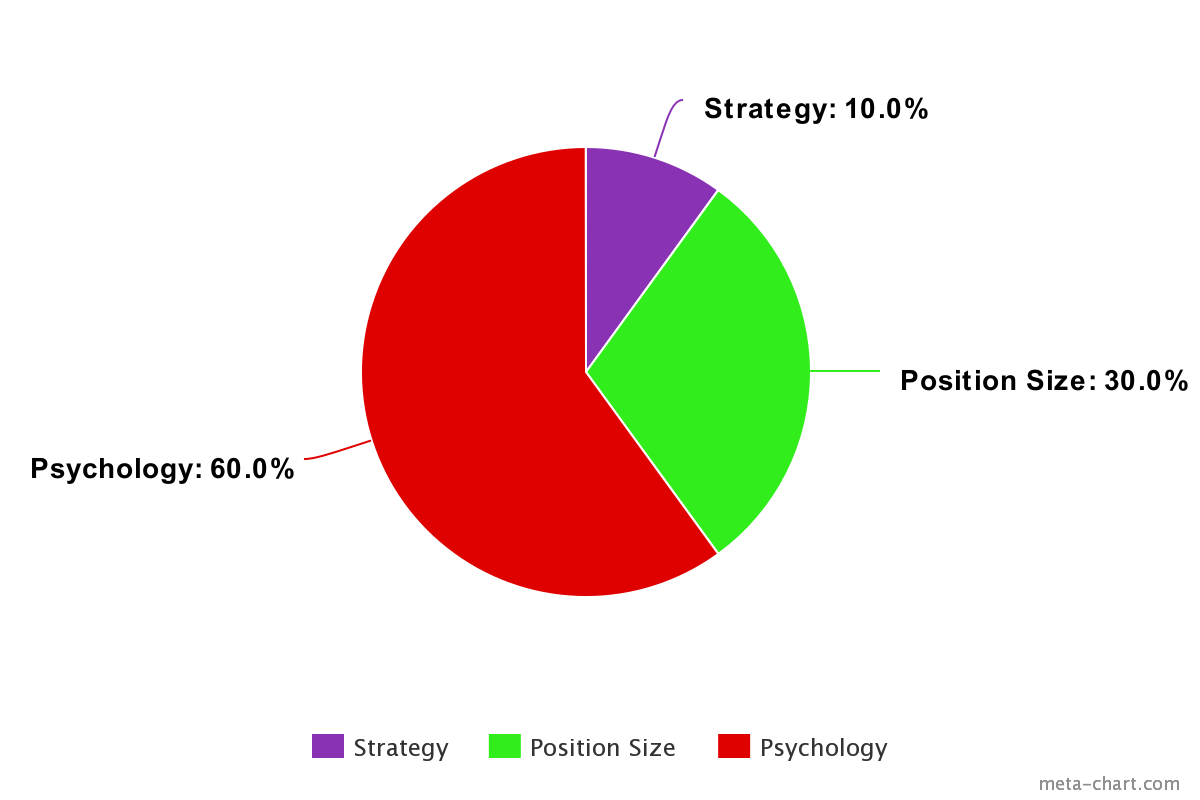

I am a big fan of the four stages of competency model for learning new skills. The goal is to become so comfortable with something that you are able to do it without consciously applying mental energy, think driving your car or navigating your phone. The issue with a gambling addiction is you get stuck in the stage of consciously incompetent. You know that you are not a profitable trader yet you are convinced you can make it back because of what you have seen on Twitter. Doomed to stare at charts until you finally run out of money, only then can you really understand that you’ve been incompetent the entire time. There are many degrees with this, but generally the further you slide the leverage bar to the right and the shorter your time horizon the more likely it is that you will lose your money.

Gambling addiction is centre stage when you enter the NFT space, there are endless opportunities to lose your money and be stuck with a JPEG to remind you of the time you were stupid enough to spend thousands on it. NFT influencers love to promote the latest ‘degen mint’, a phrase used by many on my Twitter mute and block list. Let’s pull up the definition for degenerate again: having lost the physical, mental, or moral qualities considered normal and desirable; showing evidence of decline. Yep, looks about right. Just as Youtubers lead retail to the slaughter trying to time the market, NFT influencers use phrases like ‘degen mint’ in order to justify dumping their pre-purchased and undisclosed bag on their followers.

Edward Bernays is a lesser known character in the history of man but no doubt a very important one (you can watch more about his story here). By convincing people that they want something they do not need, Bernays sought to turn citizens and neighbours into consumers who use their purchasing power to propel themselves down the road to happiness. Little did he know that one day people would be speculating on monkey photos with magic internet money long after he created the consumer that wants what they do not need.

One of my favourite Tweets of all time comes from GCR, it is a beautiful reminder of the deep sorrow that comes with the every day man’s need to find shelter through distraction and hope. The NFT ecosystem leans on a lot of the addictive attributes that slot machines use, as well as the psychology behind loot boxes that have skyrocketed in use over the past decade. Market participants have a small chance of minting a ‘rare’ which will be worth a significant premium, this is akin to the ‘jackpot’ we see in many gambling vehicles. It also has the ‘loss disguised as a win’ feature where you may not mint a rare, and you also might lose money but you will get something back on the investment if you wanted to sell right away, and even if it’s worthless you still get a JPEG!

In the Solana ecosystem we have several NFT projects that offer decentralised casinos for users to gamble with their hard-earned $SOL. In what can only be seen as incredibly irrational or addictive behaviour, people pay to flip a digital coin programmed for the house to never lose. To make things worse, there are people flipping as I write this with $SOL being down more than 85% from the top. One day these degens may look back at the time where they were losing hundreds of $SOL while it seemed cheap and wonder what could have been if they simply held their bag and didn’t cave to their boredom (or addiction). Some of these collections also distribute a portion of the house profits to holders of their NFT, which gives holders the incentive to promote their casino operations to their following—WAGMI, right?

NFT Twitter is impressively worse when it comes to being bombarded by the wins of others, with even more upside than trading. The worst part about this is that it feels much more relatable to the average market participant than the trades and PnL screenshots of larger capital traders. It’s easy to be self-aware of the fact you are not capable of opening a $1m long position but you may have just missed out on the mint you saw someone make 100k on. Humans consistently overestimate how small their odds really are. They overlook how many barriers are between what happened in reality and what could have happened if something went differently. Could I have minted several Bored Apes because I had the ETH and was aware of the mint? Absolutely. Would I have held them all until 150 ETH and made millions? Absolutely not. Your situation is likely the same.

Another misconception about the journey of leverage and gambling addiction in crypto is that you only need to push through this stage until you make it. It is important to remember that you are simply never too rich to lose all your money. As recently as a few weeks ago we have seen the (previously) most trusted individuals and institutions prove to be truly degenerate. 3AC and its founders were overleveraged to the tune of billions and are now in the process of filing for bankruptcy. Celsius and Blockfi both had their valuations absolutely destroyed, Voyager is insolvent and the many institutions reaping the rewards of $UST’s 20% APY had their funds evaporated. This was all off the back of what was one of the most brutal drops in the history of cryptocurrency, leading to contagion that we are still watching play out. The only thing that was safe were spot positions in non-custodial wallets.

What is much harder to justify are the many traders who lost all their money months before. The market was indeed trending down, but gambling never takes a break. One of the most unfortunate cases I have seen was a notable individual on CT who was at one point worth tens of millions, ended up filing a bankruptcy of their own and having their life changed forever.

As your net worth increases, so too does your trading size in order for you to still feel like you are making a meaningful gain. At one stage trading with $5k trying to make $500 feels risky, but on the sliding scale you may soon find that trading with $50k trying to make $5k feels boring. If you have made your worth by trading with leverage, at some point you need to lower your risk tolerance as you simply don’t need the same % returns you once did. This is much easier said than done and there are many such cases where people have made and lost life changing money.

So how can we avoid this mindset and still make money? In my opinion the best way forward is to understand your tolerance for risk and what your goal is. If you are young and happy to lose all your money, then understand you may indeed lose every last cent. If you are wanting to use crypto as a means to shave some time off your retirement, zoom out and understand the game you are playing—don’t check the charts for a while or consider a DCA system. And if you are not sure what your goal is, maybe aim in between where you are happy to take on some more risk than the HODL’rs but also be aggressive with taking profits and making sure to never put yourself in a position to lose it all.

Just as my adolescent self needed to snap the disc to finally free myself of the burden, perhaps many would benefit from stepping away for a while and removing the most damaging app from their phone. I remember some words that stuck with me from a podcast a while ago, ironically, the man who said it was none other than Zhu Su, who clearly was unable to listen to his own advice. I’m paraphrasing here but he mentioned that in a truly up-only asset class, the only way to lose money is to lose it all. If you are a long term believer in the asset class that is cryptocurrency and believe in its impact on a global scale; zoom out and understand that the only way you can lose is by not having any more capital to deploy. Getting liquidated on an $ETH position at $1200 due to high leverage will feel much worse in the future if it is worth substantially more and you look back knowing that all you needed to do was nothing.

Making money feels great, but keeping it feels even better.

**If this article has hit home and you or someone you know is struggling with gambling addiction, it’s never too late to seek help. The NHS have a questionnaire that can help determine if you have a problem and the NCPG offers help for 50 states, Canada, and the US Virgin Islands. Help is available 24/7 and is 100% confidential.

Great read!

Ty for this